At ValidExamDumps, we consistently monitor updates to the IFSE Institute CIFC exam questions by IFSE Institute. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the IFSE Institute Canadian Investment Funds Course Exam exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by IFSE Institute in their IFSE Institute CIFC exam. These outdated questions lead to customers failing their IFSE Institute Canadian Investment Funds Course Exam exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the IFSE Institute CIFC exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

Douglas, aged 73, won a lottery prize of $100,000 last week. Today he contacted Vincent, his Dealing Representative, with instructions to contribute the winnings to his registered retirement income fund (RRIF) account.

Which of the following statement about RRIF is CORRECT?

Which among the following BEST describes a company's income statement?

Evan owns retractable preferred shares of Ingram Corp. Which statement CORRECTLY describes a key feature of Evan's shares?

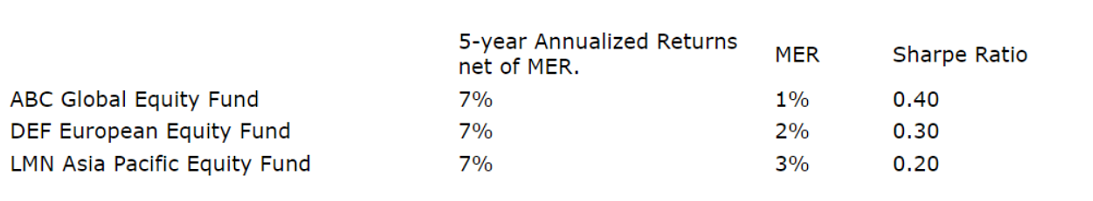

Danny is a Dealing Representative for Everbright Investments. He met with his client Adele, who has $1,000,000 to invest. During their meeting Danny determines that Adele has a high-risk profile. In addition, he learns that she has an excellent understanding of equities and how volatile they can be. Danny is considering recommending growth funds specifically, and making a recommendation from the following investment options:

Based on the information provided, which mutual fund should Danny recommend?

On which of the following does the Personal Information Protection and Electronic Documents Act (PIPEDA) impose requirements?