At ValidExamDumps, we consistently monitor updates to the CIMAPRO19-P01-1 exam questions by CIMA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the CIMA P1 Management Accounting exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by CIMA in their CIMAPRO19-P01-1 exam. These outdated questions lead to customers failing their CIMA P1 Management Accounting exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the CIMAPRO19-P01-1 exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

A medium-sized manufacturing company, which operates in the electronics industry, has employed a firm of consultants to carry out a review of the company's planning and control systems. The company presently uses a traditional incremental budgeting system and the inventory management system is based on economic order quantities (EOQ) and reorder levels. The company's normal production patterns have changed significantly over the previous few years as a result of increasing demand for customized products. This has resulted in shorter production runs and difficulties with production and resource planning. The consultants have recommended the implementation of activity based budgeting and a manufacturing resource planning system to improve planning and resource management.

What are the benefits for the company that could occur following the introduction of an activity based budgeting system?

Select ALL the correct answers.

References:

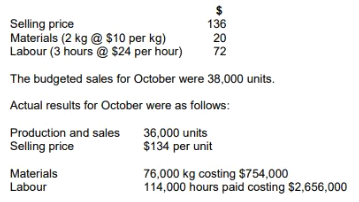

GH manufactures a product using skilled labour and high quality materials. The company operates a standard costing system and a just-in-time (JIT) purchasing and production system. The standard selling price and variable costs for one unit of the product are as follows:

Prepare a statement that reconciles the budgeted contribution with the actual contribution for October. Your statement should show the variances in as much detail as possible.

What was the actual contribution for October?

References:

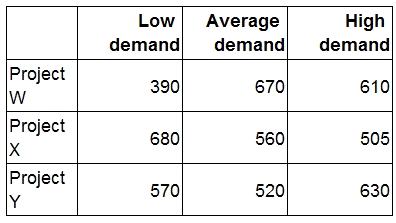

A manager must select one of three projects, W, X or Y.

The following payoff table has been prepared to show the outcomes in $000 at three possible levels of demand:

The manager is now preparing a regret matrix.

What figure (in $000) will be shown for Project Y in the regret matrix if the average demand arises?

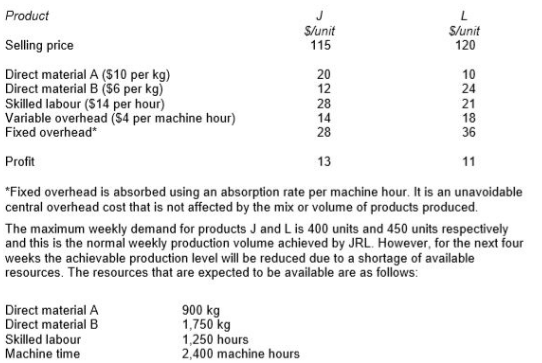

JRL manufactures two products from different combinations of the same resources. Unit selling prices and unit cost details for each product are as follows:

Identify, using graphical linear programming, the weekly production schedule for products J and L that will maximize the profits of JRL during the next four weeks.

References:

Which of the following would cause an adverse fixed overhead volume variance?