At ValidExamDumps, we consistently monitor updates to the CIMAPRO19-CS3-1 exam questions by CIMA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the CIMA Strategic Case Study Exam exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by CIMA in their CIMAPRO19-CS3-1 exam. These outdated questions lead to customers failing their CIMA Strategic Case Study Exam exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the CIMAPRO19-CS3-1 exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

Save North Forest!

North Forest is located in an area of outstanding natural beauty that also includes a number of small towns and villages. Many local residents moved into the area after retiring and were attracted by the opportunity to breathe fresh air and be surrounded by beautiful views. In doing so, we have brought wealth into a local economy that was struggling because there was little employment to encourage younger people born in the area to stay.

Wodd plans to destroy North Forest in order to fuel a power station that will, in itself, spoil the view as well as polluting the atmosphere.

Globally, vast areas of forests are cleared every year for commercial exploitation. This creates untold risks for the planet because trees are responsible for giving us breathable air.

Local residents are working together with Green Marland, Marland's largest environmental campaigner, to draw attention to the damage that Wodd is threatening to inflict on this area.

We ask you to write to the Government planning department to ask it to refuse to issue a permit for this development. We also ask you to sign our online petition and to consider joining us in peaceful and non-violent direct action against the bulldozers in the event that our efforts to block the granting of a Government permit should fail.

Two weeks have passed since the article about Wodd's role in tax avoidance was published. Thankfully, the initial reaction was to condemn the celebrities who invest in tax avoidance and little was said about Wodd's role in facilitating tax-efficient investments.

You have received the following email from Sarah Johns, Marketing Director:

From: Sarah Johns, Marketing Director

To: Senior Finance Manager

Subject: Forestry certification

Hi,

I am told that you would be a good person to talk to concerning the practical implications of a new venture that has been proposed.

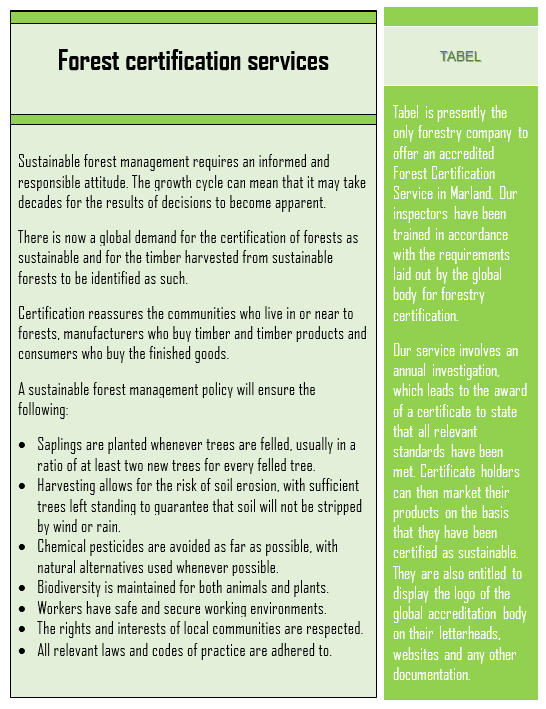

I have attached a sales brochure that I downloaded from Tabel's website. Tabel is a competing forestry company that has similar interests to our own. It has recently launched the certification scheme that it has described in its brochure. It has no competition for this certification in Marland because no other company has sought the qualifications required to offer an accredited Forest Certification Service.

Wodd has the necessary skills to offer a credible Forest Certification Service. Our forestry managers already aim to exceed all of the requirements set out by the global body. We also have a well-resourced internal audit department. I believe that we could transfer either forestry managers or internal auditors to a new external certification department. The transferred staff would complete the training required by the global body and would sit the associated examinations. We could then compete with Tabel's service.

I need your advice on the following:

Could you explain how you imagine that a typical certification investigation would work and the skills that it would require? That will help us to decide whether to approach forestry managers or internal auditors and will also enable us to describe the work that they would be doing if they agreed to be transferred.

What are the challenges associated with motivating and evaluating the investigators in the certification service and how might we address these?

Sarah

Reference Material:

The following email has been forwarded to you by William Seaton, Director of Finance:

From: William Seaton, Director of Finance

To: Finance Manager

Subject: Email from CFO of Fouce Oil

Hi

This email arrived last night. I need you to help me to think through the various implications of doing what it suggests before I present it to the Board. I need you to focus on the following issues:

Would this proposal make sense from a strategic point of view?

If we did decide to go ahead, what would be the issues that we would have to consider with respect to informing the

stock market?

Could you please email me your thoughts within the next hour? I have to brief the Board later today.

Thanks

William

The email referred to can be found by clicking on the Reference Materials button.

SIMULATION

A week later, Romuald Marek stops by your workspace and hands you a document.

The Board minute extract from Romuald can be viewed by clicking the Reference Material button above.

Reference Material

Board minutes extract: proposal to profit from ongoing strength of NS

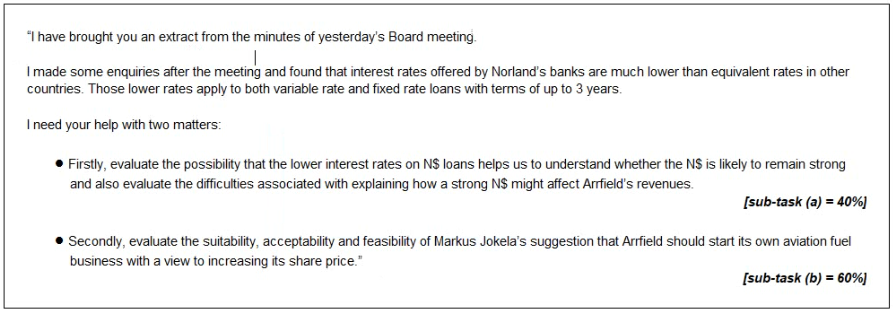

Anna Obalowu Sole, Chief Operating Officer, reported that the strong NS was helping generate revenues from fuel sales. Discussion followed as to whether the strong N$ was likely to persist and whether a strong N$ benefits Arrfield overall.

Markus Jokel

a. Chief Executive Officer, stated that the Board should develop contingency plans that could be implemented if it seemed likely that the strong N$ would persist. In particular. Arrfield need not renew the contracts that permit aviation fuel suppliers to operate from its airports. Arrfield would then be free to create its own fuel sale business, buying fuel in bulk to replenish the storage tanks at each of its airports in Norland and then selling it directly to airlines He stated that this would almost certainly enhance Arrfield's share price

Romuald Marek reminded the Board that four of Arrfield's six airports are located in Norland and that those airports charge for aeronautical and non-aeronautical services in N$.

Requirement : 1

A strong domestic currency in the Aviation business makes the business more profitable. It is evident form interest rate parity that the exchange rate of currency appreciate as the interest rate fall. The interest rate of the Norland is lower than other countries will make the N$ appreciated as compare to the other countries.

A strong domestic currency is not always good for the Aviation business. It intrinsically involves the use of foreign currency on regular basis. A strong NS may decrease the revenues of the Arrfield because it will become costly for the airlines from abroad. The airlines may find airport of other nearby countries with cheaper currency which will allow them cost savings with the use of cheaper currency.

Requirement : 2

By starting aviation fail business by the Arrfield could increase the share price.

Suitability:

The aviation fuel business suits to Arrfield because of three reasons. 1- It will be taken by the market as backward integration. This will reduce the risk of the Arrfield significantly. 2- The companies in Norland with a strong currency are able to import cheaper fuel and offering discount to airlines. This can be profitable business. 3- The criticism by the environmentalists may be managed by taking corrective actions i.e. selling fuel at full price.

The Airfield could club the fuel charges into the landing, take off and terminal usage fee, this could ease the process for the airlines could make the airports more popular. The Arrfield could also manage the fuel inventory as per requirements because they have the schedule of the flights.

Acceptability:

The shareholders of the Arrfield will accept the proposal as it seems profitable and it may increase the shar price of the Arrfield share because of the material information regarding starting a new business line will give positive feed sign. The reputation risk arise from article a week before regarding selling cheaper fuel may also be mitigated by taking over the business and corrective actions may be taken.

The matter will not be appreciated by the companies they would wish to continue with Arrfield. They must also be satisfied on termination of contract.

Feasibility:

Arrfield have 4 major airports (three hub and a spoke) in Norland. The hub airports are big and planes are fueled with the underground pipelines and workforce work in close connection with the fuel companies. The Arrfield have the infrastructure to start its business of aviation fuel.

William Seaton, the Director of Finance stopped you in the corridor a week after the Head Geologist's announcement that reserves had been overstated:

''We informed the stock exchange that our reserves had been downgraded and our share price has taken a solid hit. We need to work towards making sure that this is never repeated.

The Board is actively considering some changes that we hope will improve our forecasting system. I am not convinced that the suggestions will work. Frankly, if we could predict the future with certainty then I would have us stop looking for oil and start selling forecasts.

I would like you to work through the proposals that have been put forward and to recommend on their adoption, with changes if you think it necessary. The issues that we are most seriously considering are:

A suggestion that Big Data could be used to monitor oil prices. Do you think this would be a sensible way to proceed?

A suggestion that we should update our reserves information on the company website in real time. Do you think that would be an effective communication strategy?

Finally, we have considered a number of issues surrounding the motivation and inspiration of our geologists. Two quite distinct schemes have been proposed. Firstly, some Board members believe that our geologists should be rewarded in relation to the accuracy of their forecasts. Bonuses will be paid on the basis of correct initial evaluation of wells. The bonus will increase if a well that was initially identified as commercially viable goes into production and will decrease if a well that was classified as viable is reclassified as unproductive.

Secondly, other members of the Board believe that there should be a greater degree of accountability on the part of geologists. The incorrect classification of a well's potential could be treated as a disciplinary matter. Please provide a detailed analysis of EACH of those suggestions.''