At ValidExamDumps, we consistently monitor updates to the CIMAPRA19-F02-1 exam questions by CIMA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the CIMA F2 Advanced Financial Reporting exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by CIMA in their CIMAPRA19-F02-1 exam. These outdated questions lead to customers failing their CIMA F2 Advanced Financial Reporting exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the CIMAPRA19-F02-1 exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

GH acquired3,000,000 of the 12,000,000 equity shares of JK. All shares carried equal voting rights and no other single shareholder of JK held more than 10% of the equity shares. GH has the power to participate in the financial and operating policy decisions but not control them.

Based on the information provided above, how would GH's investment in JK be accounted for in its consolidated financial statements?

ABacquired 90% of the equity ofYZon31 December 20X2. On the same date YZ acquired 60% of the equity shares ofVW for $750,000. AB has no other subsidiaries.

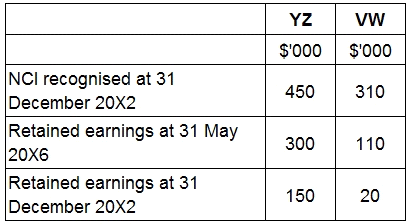

The following information regarding YZ and VW was available:

Whatamount will AB include in its consolidated statement of financial position in respect ofnon controlling interestat 31 May 20X6?

Which of the following statements are true regarding consolidated cash flows after the acquisition of a subsidiary?

Select ALL that apply.

You are a Financial Controller at BCD and are in the process of preparing the year-end financial statements. A member of your finance team has come to see you about her provisions balance at year-end.

She says that the Managing Director has asked her to increase the provisions balance by $1 million overall. She thinks this is because BCD has had a very good year in terms of profit, and the Managing Director wants to put some profit aside to protect against any future reductions in profit. $1 million is material to BCD.

Youbelieve that the provisions balance wasfairly stated without the additional $1 million.

Which TWO of the following would be appropriate actions in this scenario?

Whichof the following taken independently would explain the reduction in the profits as highlighted by the Chairman's press release?