At ValidExamDumps, we consistently monitor updates to the CIMAPRA17-BA2-1 exam questions by CIMA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the CIMA BA2 - Fundamentals of Management Accounting exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by CIMA in their CIMAPRA17-BA2-1 exam. These outdated questions lead to customers failing their CIMA BA2 - Fundamentals of Management Accounting exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the CIMAPRA17-BA2-1 exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

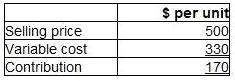

A confectionery manufacturer is considering adding a new product to the current range. Forecast data for the product are as follows.

Incremental fixed costs attributable to the new product are forecast to be $24,000 each period.

The forecast sales volume of 180 units is insufficient to achieve the target profit of $10,000 each period.

Which of the following statements is correct?

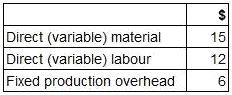

The forecast costs per unit for a new product are as follows:

The company uses marginal cost plus pricing and all products are required to achieve a 40% margin.

What would be the selling price per unit?

In an integrated cost and financial accounting system, the accounting entries for the cost of production units completed in the period would be:

The net present value (NPV) of an investment is as follows.

NPV at 14% = $6,320

NPV at 18% = ($4,600) negative

The internal rate of return (IRR) of the investment is closest to