At ValidExamDumps, we consistently monitor updates to the CFA Institute CFA-Level-II exam questions by CFA Institute. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the CFA Institute CFA Level II Chartered Financial Analyst exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by CFA Institute in their CFA Institute CFA-Level-II exam. These outdated questions lead to customers failing their CFA Institute CFA Level II Chartered Financial Analyst exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the CFA Institute CFA-Level-II exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

Ron Natin heads a committee that oversees the USA Insurance portfolio with total assets of $25 billion. The portfolio has 15% of total assets allocated to foreign investments, which include both international stocks and bonds. The committee has adopted a position that the domestic markets are efficient and thus, has indexed the domestic portion of the portfolio. Each unique asset class in the domestic portfolio has been benchmarked individually. The committee believes that foreign markets are less efficient and utilizes active managers for this asset class. The foreign allocation is 60% stocks and 40% bonds. The committee has divided the foreign stock portfolio equally among three different managers. The committee closely monitors the risk level of these managers by reviewing their portfolio betas (current betas: 1.1, 0.95, and 1.3).

As part of his committee responsibilities, Natin is required to review all reports and speeches prepared by other members of the committee before they are presented to the public. One of the committee members, Mclanie Henley, has submitted a speech on the subject of international diversification and the international capital asset pricing model (ICAPM) that she will give to a group of MBA students at a local university. Following are excerpts from her proposed speech:

International investment and diversification is an important concern in money management and, of the many relevant issues to discuss, there are two key insights that I will Take time to explain. First of all, it is essential to realize that the currency exposure of a foreign stock investment is the sensitivity of the stock price to a change in the value of the local currency and that a positive correlation between stock prices and the local currency would mean that the local stock price increases as a result of a depreciation of the local currency. Second, as future asset managers you should realize that improvements in a foreign nation's economic activity that result in an increase in real interest rates will decrease bond prices, but will be offset by an appreciation of the home currency.

The ICAPM is similar to the domestic CAPM in several ways. For example, both models assume that investors are risk-averse, preferring lower levels of risk and greater expected returns, that all investors have the same expectations for the risk and return of every asset, and that all investors should hold some combination of a risk-free asset and the market portfolio.

The IGAPM is a useful construct to determine asset prices in a global context. Strategies that depend explicitly on asset prices derived from the ICAPM can rely on these asset prices even if currency hedging is inhibited in certain markets by legal restrictions on such activities.

Evaluate Henley's statements in her proposed speech comparing the domestic CAPM to the ICAPM and her statement regarding the hedging restrictions and the ICAPM.

Henley's comments regarding (he similarities and differences berween the domestic CAPM and ICAPM are correct. The basic assumptions of the domestic CAPM and ICAPM are the same: investors arc risk averse, all investors have uniform expectations of risk and return on all assets, and all investors hold some combination of a risk-free asset and the market portfolio. The domestic CAPM defines the market portfolio as all domestic assets, while the ICAPM defines the market portfolio as constructed out of the global universe of risky assets. Henley's comment regarding the effect of hedging restrictions is incorrect. The ICAPM breaks down if currency hedging is not available as a result of physical or legal restrictions on such activities. (Study Session 18, LOS 66.c,i,k)

MediSoft Inc. develops and distributes high-tech medical software used in hospitals and clinics across the United States and Canada. The firm's software provides an integrated solution to monitoring, analyzing, and managing output from a variety of diagnostic medical equipment including MRls, CT scans, and EKG machines. MediSoft has grown rapidly since its inception ten years ago, averaging 25% growth in sales over the last decade. The company went public three years ago. Twelve months after their IPO, MediSoft made two semiannual coupon bond offerings, the first of which was a convertible bond. At the time of issuance, the convertible bond had a coupon rate of 7.25%, par value of $1,000, a conversion price of $55.56, and ten years until maturity. Two years after issuance, the bond became callable at 102% of par value. Soon after the issuance of the convertible bond, the company issued another series of bonds which were putable, but contained no conversion or call features. The putable bonds were issued with a coupon of 8.0%, par value of $1,000, and 15 years until maturity. One year after their issuance, the put feature of the putable bonds became active, allowing the bonds to be put at a price of 95% of par value, and increasing linearly over five years to 100% of par value. MediSoft's convertible bonds are now trading in the market for a price of $947 with an estimated straight value of $917. The company's putable bonds are trading at a price of $1,052. Volatility in the price of MediSoft's common stock has been relatively high over the last few months. Currently the stock is priced at $50 on the New York Stock Exchange and is expected to continue its annual dividend in the amount of $1.80 per share.

High-tech industry analysts for Brown & Associates, a money management firm specializing in fixed-income investments, have been closely following MediSoft ever since it went public three years ago. In general, portfolio managers at Brown & Associates do not participate in initial offerings of debt investments, preferring instead to see how the issue trades before considering taking a position in the issue. Since MediSoft's bonds have had ample time to trade in the marketplace, analysts and portfolio managers have taken an interest in the company's bonds. At a meeting to discuss the merits of MediSofVs bonds, the following comments were made by various portfolio managers and analysts at Brown & Associates:

"Choosing to invest in MediSoft's convertible bond would benefit our portfolios in many ways, but the primary benefit is the limited downside risk associated with the bond. Since the straight value will provide a floor for the value of the convertible bond, downside risk is limited to the difference between the market price of the bond and the straight value."

"Decreasing volatility in the price of MediSoft's common stock as well as increasing volatility in the level of interest rates are expected in the near future. The combined effects of these changes in volatility will be a decrease in the price of MediSoft's putable bonds and an increase in the price of the convertible bonds. Therefore, only the convertible bonds would be a suitable purchase."

Assuming that portfolio managers at Brown & Associates purchased the convertible bonds, how many years would it take to recover the premium per share?

We calculated the market premium per share in the previous question so we must now calculate the favorable income differential per share as follows:

(Study Session 14, LOS 54.j)

Rock Torrey, an analyst for International Retailers Incorporated (IRI), has been asked to evaluate the firm's swap transactions in general, as well as a 2-year fixed for fixed currency swap involving the U .S . dollar and the Mexican peso in particular. The dollar is Torrey's domestic currency, and the exchange rate as of June 1,2009, was $0.0893 per peso. The swap calls for annua! payments and exchange of notional principal at the beginning and end of the swap term and has a notional principal of $100 million. The counterparty to the swap is GHS Bank, a large full-service bank in Mexico.

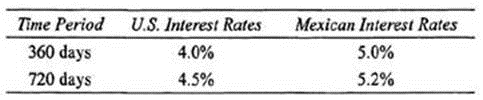

The current term structure of interest rates for both countries is given in the following table:

Torrey believes the swap will help his firm effectively mitigate its foreign currency exposure in Mexico, which sterns mainly from shopping centers in high-end resorts located along the eastern coastline. Having made this conclusion, Torrey begins writing his report for the management of IRI. In addition to the terms of the swap, Torrey includes the following information in the report:

* Implicit in the currency swap under consideration is a swap spread of 75 basis points over 2-year U .S . Treasury securities. This represents a 10 basis point narrowing of the spread as compared to this time last year. Thus, we can assume that the credit risk of the global credit market has decreased. Unfortunately, the decline provides no insight into the credit risk of the individual currency swap with GHS Bank, which could have increased.

* In order to decrease the counterparty default risk on the currency swap, we will need to utilize credit derivatives between the beginning and midpoint of the swap's life when this particular risk is at its highest. This is a significantly different strategy than we normally use with interest rate swaps. For interest rate swaps, counterparty default risk peaks at the middle of the swap's life, at which point we utilize credit derivative CQuntermeasures to offset the risk.

* Because currency swaps almost always include netting agreements and interest rate swaps can be structured to include mark-to-market agreements, we can significantly reduce the credit risk of these swap instruments by negotiating swap contracts that include these respective features. When negotiating these features is not possible, credit risk can be reduced by using off-market swaps that do not require an initial payment from IRI.

Six months have passed (180 days) since Torrey issued his report to IRI's management team, and the current exchange rate is now $0,085 per peso. The new term structure of interest rates is as follows:

Determine whether the excerpt from Torrey's report regarding the timing of peak credit risk is correct with regard to currency swaps and interest rate swaps.

The assumption is that the credit risk is low at the beginning of the swap because each counterparty accepted the creditworthiness of the other in order to initiate the transaction. By the middle of the swap's life, payments are coming due and credit risk increases. In interest rate swaps, the credit risk would then decline as the remaining payments were made towards the end of the swap's life. For currency swaps, however, with the exchange of notional principal, the final payment keeps credit risk high through the end of the swap life, causing it to peak between the middle and the end of the swap's life. (Study Session 17, LOS 6l.i)

James Walker is the Chief Financial Officer for Lothar Corporation, a U .S . mining company that specializes in worldwide exploration for and excavation of precious metals. Lothar Corporation generally tries to maintain a debt-to-capital ratio of approximately 45% and has successfully done so for the past seven years. Due to the time lag between the discovery of an extractable vein of metal and the eventual sale of the excavated material, the company frequently must issue short-term debt to fund its operations. Issuing these one to six month notes sometimes pushes Lothar's debt to capital ratio above their long-term target, but the cash provided from the short-term financing is necessary to complete the majority of the company's mining projects.

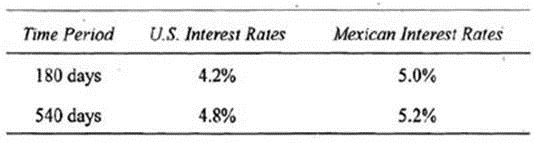

Walker has estimated that extraction of silver deposits in southern Australia has eight months until project completion. However, funding for the project will run out in approximately six months. In order to cover the funding gap. Walker will have to issue short-term notes with a principal value of $1,275,000 at an unknown future interest rate. To mitigate the interest rate uncertainty, Walker has decided to enter into a forward rate agreement (FRA) based on LIBOR which currently has a term structure as shown in Exhibit 1.

Three months after establishing the position in the forward rate agreement, LIBOR interest rates have shifted causing the value of Lothar's FRA . position to change as well. The new LIBOR term structure is shown in Exhibit 2.

While Walker is estimating the change in the value of the original FRA position, he receives a memo from the Chief Operating Officer of Lochar Corporation, Maria Steiner, informing him of a major delay in one of the company's South African mining projects. In the memo, Stciner states the following: "As usual, the project delay will require a short-term loan to cover funding shortage that will accompany the extra time until project completion. I have estimated that in 210 days, we will require a 90-day project loan in the amount of $2,350,000.1 would like you to establish another FRA position, this time with a contract rate of 6.95%."

Which of the following is closest to the value of the forward rate agreement three months after the inception of the contract (from Walker's perspective)? For this question only, assume that the interest rate at inception was 6.0%.

For this question, we must find the value of the FRA 3 months or 90 days after the inception of the contract. First find the contract rate on a new FRA . Since we are 90 days past the inception of the original contract an equivalent new contract would be a 3 x 5 FRA, which would represent a 2 month (60 day) loan that would begin three months (90 days) from now. Thus, the relevant LIBOR rates are going to be 90-day and 150-day LIBOR. Calculate the FRA rate the same way as in the previous question:

(Study Session 16,105 58.0)

Introduction

Rajesh Singh is the CFO of Goldensand Jewelry, Ltd, a London-based retailer of fine jewelry and watches. Singh has noticed that the price of gold has begun to increase. If economic activity continues to pick up, the price of gold is likely to accelerate its rate of increase as both the level of demand and inflation rates increase.

Implications of Rising Gold Price

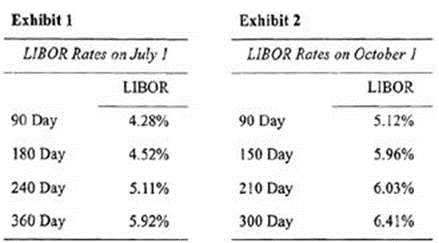

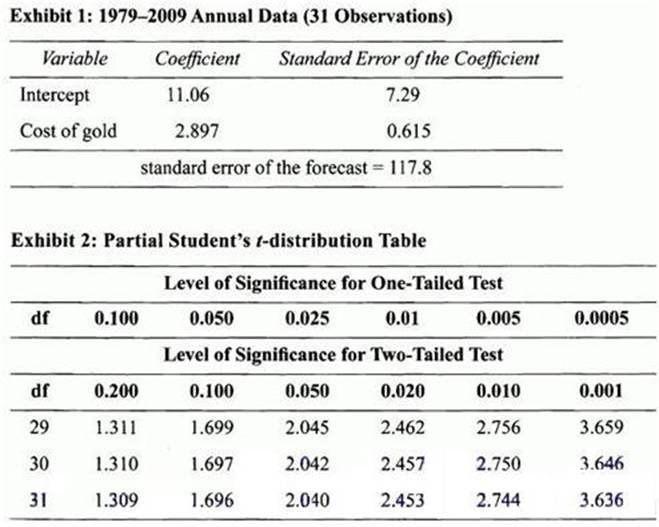

Singh has become concerned about the cost implications for Goldensand if gold prices continue to rise. He has requested a meeting with Anita Biscayne, Goldensand's COO. In preparation for the meeting, Singh asked one of his staff, Yasunobu Hara, to prepare a regression analysis comparing the price of gold to the average cost of Goldensand's purchases of finished gold jewelry. Hara provides the regression results as shown in Exhibit 1.

Reviewing the regression results, Biscayne becomes concerned about the implications for the cost of finished jewelry to Goldensand if the price of gold continues to rise. To remain profitable, the cost of finished jewelry should not exceed $2,000.

Regression Concerns

Overall Concerns

Singh's principal concern about the regression is whether the time period chosen is a good predictor of the current situation. He makes the following statement:

Statement 1: We may have a problem with parameter instability if the relationship between gold prices and jewelry costs has changed over the past 30 years. Singh also focuses on the value of the slope coefficient. He expected it to be 4.0 based on his experience in the industry. Hara computes the appropriate test statistic and reports the following:

Statement 2: We fail to reject the null hypothesis that the slope coefficient is equal to 4.0 at the 5% level of significance.

Testing for Heteroskedasticity

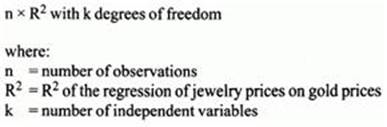

Biscayne remarks that the dramatic increase in the price level over the past 30 years leads her to suspect heteroskedasticity in the regression results. She suggests to Singh that they should conduct a Breusch-Pagan chi-square test for heteroskedasticity by calculating the following test statistic:

Model Misspecification

Biscayne and Singh have various views on the potential for model misspecification and the effect of any such misspecification.

* Biscayne worries that the regression model is misspecified because it does not include a variable to measure the cost of the highly specialized labor used by manufacturing jewelers. She points out that the effect of omitting an important variable in a regression analysis is that the regression coefficients will be unbiased and inconsistent.

* Singh adds that another common consequence of misspecifying a regression analysis is creating undesired stationarity.

Multiple Regression

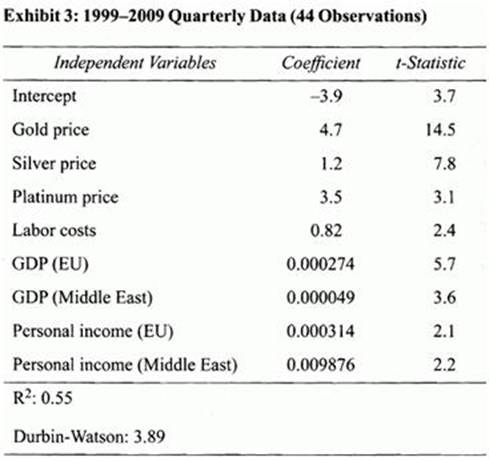

Hara conducts a series of regression analyses using all possible combinations of the suggested independent variables based on their average quarterly values. He returns with the following regression results as shown in Exhibit 3 for the equation which uses all suggested independent variables.

Hara is concerned about the equation described in Exhibit 3. He makes the following statement:

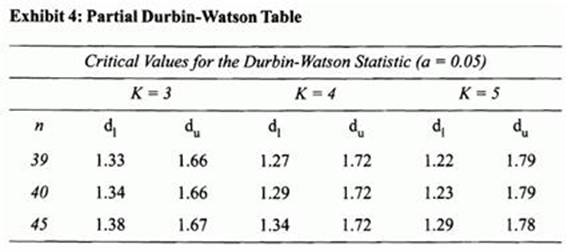

Statement 3: The Durbin-Watson statistic indicates the presence of positive autocorrelation at the 5% level.

Biscayne responds with the following statement:

Statement 4: An autocorrelation problem can be addressed by using the Hansen method to adjust the .

Are Singh (Statement 1) and Hara (Statement 2) correct or incorrect regarding the usefulness of regression results described in Exhibit 1 and the value of the slope coefficient?

Singh is correcr that a change in the relationship between gold prices and jewelry costs would be an example of parameter instability.

Hara is correct to fail to reject the null hypothesis that the value of the slope coefficient is equal to 4.0 at the 5% level of significance.

The critical f-value for the slope coefficient with 31 - 2 = 29 df at the 5% level for a two-tailed test is 2.045- The test statistic is (2.897 - 4.000)/0.6l 5 = -1.79. The absolute value (1.79) is less than 2.045, and the correct decision is to fail to reject the null hypothesis that the slope coefficient is equal to 4.0. (Study Session 3. LOS 1 l.g, LOS 13.g)