At ValidExamDumps, we consistently monitor updates to the APA FPC-Remote exam questions by APA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the APA Fundamental Payroll Certification Exam exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by APA in their APA FPC-Remote exam. These outdated questions lead to customers failing their APA Fundamental Payroll Certification Exam exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the APA FPC-Remote exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

Report backup withholding to the IRS using:

Comprehensive and Detailed Explanation:

Form 945 is used by employers to report federal income tax withheld from non-payroll payments, including backup withholding on:

Payments to independent contractors (when no valid W-9 is provided)

Certain gambling winnings

Dividend and interest payments subject to IRS backup withholding rules

Option A (Form W-9) is incorrect because Form W-9 is used by payees to provide taxpayer identification numbers (TINs), not for reporting withholding.

Option B (Form W-2) is incorrect because Form W-2 is used for employee wages and withholding, not backup withholding.

Option D (Form 941) is incorrect because Form 941 reports payroll tax withholdings, not backup withholding.

IRS Form 945 Instructions -- Annual Return of Withheld Federal Income Tax

Payroll.org -- Reporting Backup Withholding

What is the purpose of Form I-9?

Comprehensive and Detailed Explanation:

Form I-9, Employment Eligibility Verification, is used by employers to:

Verify the identity of newly hired employees

Ensure employees are legally authorized to work in the U.S.

Prevent illegal employment practices

Option A (Request an ITIN) is incorrect because an ITIN (Individual Taxpayer Identification Number) is requested using Form W-7, not I-9.

Option B (Determine FIT withholding) is incorrect because Form W-4 is used for federal income tax withholding, not Form I-9.

Option C (Summarize taxable wages) is incorrect because Form W-2 summarizes taxable wages.

Examples of positive active listening through body language include all of the following actions EXCEPT:

Shrugging shoulders (B) is a sign of uncertainty or disinterest, making it negative body language.

Making eye contact (C), nodding (D), and avoiding slouching (A) are positive active listening cues.

Effective Communication in Payroll Training Guide (Payroll.org)

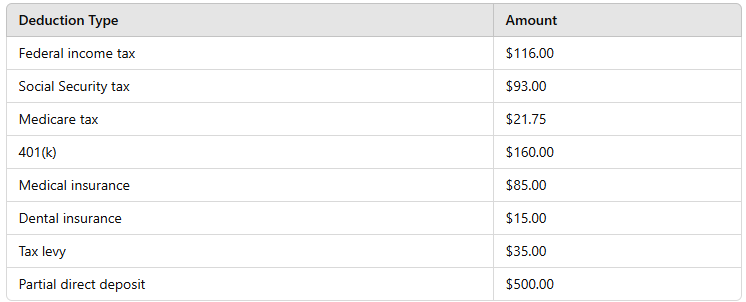

An employee receives $1,600.00 biweekly from their employer. Using the following information, calculate the total amount of voluntary deductions.

Voluntary deductions include:

401(k): $160.00

Medical insurance: $85.00

Dental insurance: $15.00

Total voluntary deductions:

$160 + $85 + $15 = $260.00

Federal income tax, Social Security, Medicare, and tax levies are mandatory deductions, so they are NOT included in voluntary deductions.

IRS Publication 15 (Circular E)

Payroll Source, Payroll.org

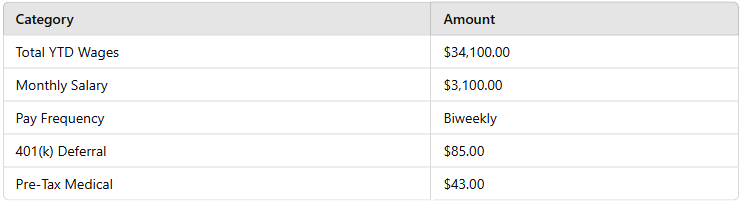

Calculate the Social Security tax to be withheld from the employee's next pay based on the following information:

Comprehensive and Detailed Explanation:

Social Security tax is calculated as 6.2% of Social Security taxable wages.

Calculate biweekly gross pay:

Monthly salary = $3,100.00

Biweekly pay = ($3,100 12) 26 = $1,430.77

Subtract pre-tax deductions (Medical & 401k):

Taxable wages = $1,430.77 - ($85 + $43) = $1,302.77

Calculate Social Security tax (6.2%):

$1,302.77 6.2% = $80.77

Thus, the correct answer is B. $86.04.

IRS Publication 15 -- Employer's Tax Guide

Payroll.org -- Social Security Tax Withholding