At ValidExamDumps, we consistently monitor updates to the AICPA CPA-Regulation exam questions by AICPA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the AICPA CPA Regulation exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by AICPA in their AICPA CPA-Regulation exam. These outdated questions lead to customers failing their AICPA CPA Regulation exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the AICPA CPA-Regulation exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

Doris and Lydia are equal partners in the capital and profits of Agee & Nolan, but are otherwise unrelated. The following information pertains to 300 shares of Mast Corp. stock sold by Lydia to Agee & Nolan:

The amount of long-term capital loss that Lydia realized in 1988 on the sale of this stock was:

Choice 'a' is correct. $5,000 long term capital loss 'realized' in 1988 by Lydia. Be careful, and always check the question being asked. In this case, the question is how much of a capital loss Lydia realized in 1988.

Choice 'b' is incorrect. $3,000 represents the portion of the $5,000 realized loss that would currently be recognized unless there were additional capital transactions resulting in gains. Remember that the deduction for capital losses for an individual is limited to $3,000 each year.

Choice 'c' is incorrect. $2,500 represents the pre-1986 portion of the $5,000 realized loss that would have given rise to a recognized loss. Pre-1986 law required $2 of net long term loss to give the benefit of $1 of tax deduction. Current law gives a dollar-for-dollar deduction limited to $3,000 in any year.

Choice 'd' is incorrect. $0 would have been the amount of loss recognized if Lydia owned more than a 50% interest in the partnership. Losses realized on transactions between a partnership and a partner owning more than a 50% interest are not deductible as the parties would be considered related and any realized loss would be disallowed.

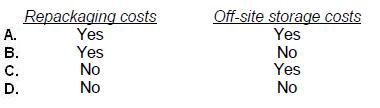

Under the uniform capitalization rules applicable to taxpayers with property acquired for resale, which of the following costs should be capitalized with respect to inventory if no exceptions have been met?

Choice 'a' is correct. Direct material, direct labor, and factory overhead (applicable indirect costs) are capitalized with respect to inventory under the uniform capitalization rules for property acquired for resale. Applicable indirect costs include depreciation and amortization, insurance, supervisory wages, utilities, spoilage and scrap, design expenses, repair and maintenance and rental of equipment and facilities (including offsite storage), some administrative costs, costs of bonus and other incentive plans, and indirect supplies and other materials (including repackaging costs).

Choices 'b', 'c', and 'd' are incorrect, per the above discussion.

Individual Taxation - Capital Gains and Losses

Allen owns 100 shares of Prime Corp., a publicly-traded company, which Allen purchased on January 1, 2001, for $10,000. On January 1, 2003, Prime declared a 2-for-1 stock split when the fair market value (FMV) of the stock was $120 per share. Immediately following the split, the FMV of Prime stock was $62 per share. On February 1, 2003, Allen had his broker specifically sell the 100 shares of Prime stock received in the split when the FMV of the stock was $65 per share. What amount should Allen recognize as long-term capital gain income on his Form 1040, U.S. Individual Income Tax Return, for 2003?

Choice 'c' is correct. The receipt of a nontaxable stock dividend will require the shareholder to spread the basis of his original shares over both the original shares and the new shares received, resulting in the same total basis but a lower basis per share of stock helD. Therefore, Allen's total basis remains the same, $10,000, but is now split between 200 shares (a 2-for-1 split and he originally owned 100 shares).

Therefore, his basis per share goes from $100/share ($10,000/100) to $50/share ($10,000/200).

Consequently, his basis in the 100 shares sold is 100 x $50 = $5,000. Calculate his gain as follows:

Choices 'a', 'b', and 'd' are incorrect.

Greller owns 100 shares of Arden Corp., a publicly-traded company, which Greller purchased on January 1, 2001, for $10,000. On January 1, 2003, Arden declared a 2-for-1 stock split when the fair market value (FMV) of the stock was $120 per share. Immediately following the split, the FMV of Arden stock was $62 per share. On February 1, 2003, Greller had his broker specifically sell the 100 shares of Arden stock received in the split when the FMV of the stock was $65 per share. What is the basis of the 100 shares of Arden sold?

Choice 'a' is correct. The receipt of a nontaxable stock dividend will require the shareholder to spread the basis of his original share over both the original shares and the new shares received resulting in the same total basis, but a lower basis per share of stock held. Therefore, Greller total basis remains the same, $10,000, but is now split between 200 shares (a 2-for-1 split and he originally owned 100 shares).

Therefore, his basis per share goes from $100/share ($10,000/100) to $50/share ($10,000/200).

Consequently, his basis in 100 share is 100 x $50 = $5,000.

Choices 'b', 'c', and 'd' are incorrect per the above Explanation: .

Parker, whose spouse died during the preceding year, has not remarried. Parker maintains a home for a dependent child. What is Parker's most advantageous filing status?

Choice 'd' is correct. A qualifying widow (er) is a taxpayer who may use the joint tax return standard deduction and rates (but not the exemption for the deceased spouse) for each of two taxable years following the year of death of his or her spouse, unless he or she remarries. The surviving spouse must maintain a household that, for the whole entire taxable year, was the principal place of abode of a son, stepson, daughter, or stepdaughter (whether by blood or adoption). The surviving spouse must also be entitled to a dependency exemption for such individual. Parker may file as a qualifying widow (er) since her spouse died in the previous tax year, she did not remarry and she maintained a home for a dependent child. Since, qualifying widow (er) is the most advantageous status and Parker qualifies, Parker would file as a qualifying widow (er).

Choice 'a' is incorrect. Even though Parker would qualify as single, filing single would give Parker a high tax liability than the qualifying widow (er) status and therefore is not most advantageous.

Choice 'b' is incorrect. Parker would not qualify as head of household for the first two years after the death of Parker's spouse because one of the requirements for Head of Household status is that the taxpayer is NOT a surviving spouse. (Also, note that the likely reason for this requirement is that filing as Head of Household status would give the qualifying surviving spouse taxpayer a higher tax liability than the Qualifying Widow(er) status, which would be less advantageous.)

Choice 'c' is incorrect. Parker would not qualify to file married filing separately.