At ValidExamDumps, we consistently monitor updates to the AICPA CPA-Financial exam questions by AICPA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the AICPA CPA Financial Accounting and Reporting exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by AICPA in their AICPA CPA-Financial exam. These outdated questions lead to customers failing their AICPA CPA Financial Accounting and Reporting exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the AICPA CPA-Financial exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

A transaction that is unusual, but not infrequent, should be reported separately as a(an):

Choice 'd' is correct. A transaction that is unusual, but not 'infrequent' should be reported separately as a component of continuing operations, (gross) but not net of applicable income taxes.

Choices 'a' and 'b' are incorrect. An extraordinary item has to be both 'unusual' and 'infrequent.'

Choice 'c' is incorrect, per 'd' above.

On January 2, 20X5, to better reflect the variable use of its only machine, Holly, Inc. elected to change its method of depreciation from the straight-line method to the units of production method. The original cost of the machine on January 2, 20X3, was $50,000, and its estimated life was 10 years. Holly estimates that the machine's total life is 50,000 machine hours. Machine hours usage was 8,500 during 20X4 and 3,500 during 20X3.

Holly's income tax rate is 30%. Holly should report the accounting change in its 20X5 financial statements as a(n):

Choice 'd' is correct. A change in the method of depreciation is now considered to be both a change in method and a change in estimate. These changes should be accounted for as changes in estimate and handled prospectively. The new depreciation method should be used as of the beginning of the year of change and should start with the current book value of the underlying asset. No retroactive or retrospective calculations should be made, and no adjustment should be made to retained earnings.

The cumulative effect treatment on the income statement was the treatment of most changes in accounting principle prior to SFAS No. 154. The adjustment to beginning retained earnings is the treatment now given to changes in accounting principle by SFAS No. 154. However a change in depreciation method is no longer accounted for as a change in accounting principle.

Choices 'a', 'b', and 'c' are incorrect, per the above Explanation: .

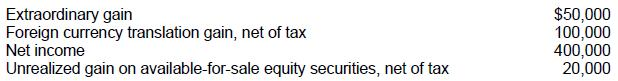

Rock Co.'s financial statements had the following balances at December 31:

What amount should Rock report as comprehensive income for the year ended December 31?

Choice 'c' is correct. Comprehensive Income includes all items included in 'Net Income' plus 'Other Comprehensive Income' items. Since the $50,000 extraordinary gain is already included in Net Income, Comprehensive Income is:

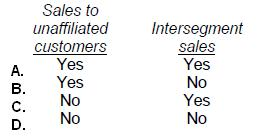

In financial reporting of segment data, which of the following must be considered in determining if an industry segment is a reportable segment?

Choice 'a' is correct. A segment is considered reportable if its reported revenue, including sales to unaffiliated customers and intersegment sales, is 10% or more of the combined revenue (unaffiliated and intersegment) of all operating segments.

Choices 'b', 'c', and 'd' are incorrect, per the above Explanation: .

Development-Stage Enterprises

On January 2, 1993, Quo, Inc. hired Reed to be its controller. During the year, Reed, working closely with Quo's president and outside accountants, made changes in accounting policies, corrected several errors dating from 1992 and before, and instituted new accounting policies.

Quo's 1993 financial statements will be presented in comparative form with its 1992 financial statements.

This question represents one of Quo's transactions. List A represents possible clarifications of these transactions as: a change in accounting principle, a change in accounting estimate, a correction of an error in previously presented financial statements, or neither an accounting change nor an accounting error.

Item to Be Answered

During 1993, Quo determined that an insurance premium paid and entirely expensed in 1992 was for the period January 1, 1992, through January 1, 1994.

List A (Select one)

Choice 'c' is correct. Expensing insurance premiums when paid (rather than allocating them to the periods benefited) is a correction of an error in previously presented financial statements.