At ValidExamDumps, we consistently monitor updates to the AICPA CPA-Auditing exam questions by AICPA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the AICPA CPA Auditing and Attestation exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by AICPA in their AICPA CPA-Auditing exam. These outdated questions lead to customers failing their AICPA CPA Auditing and Attestation exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the AICPA CPA-Auditing exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

Which of the following is not an inquiry the auditor should make to identify the risks of material misstatement due to fraud?

Moore, CPA, has been asked to issue a review report on the balance sheet of Dover Co., a nonissuer.

Moore will not be reporting on Dover's statements of income, retained earnings, and cash flows. Moore may issue the review report provided the:

Choice 'b' is correct. An accountant may issue a review report on one financial statement, such as a balance sheet, and not on other related financial statements, if the scope of the accountant's inquiry and analytical procedures has not been restricted.

Choice 'a' is incorrect. The balance sheet need not be presented in a prescribed form of an industry trade association.

Choice 'c' is incorrect. There is no limitation on the use of a reviewed financial statement.

Choice 'd' is incorrect. Specialized accounting principles should be considered by the accountant when performing the review, but need not be disclosed.

This question consists of an item pertaining to possible deficiencies in an accountant's review report. Jordan & Stone, CPAs, audited the financial statements of Tech Co., a nonissuer, for the year ended December 31, 20X1, and expressed an unqualified opinion. For the year ended December 31, 20X2, Tech issued comparative financial statements. Jordan & Stone reviewed Tech's 20X2 financial statements and Kent, an assistant on the engagement, drafted the accountants' review report below.

Land, the engagement supervisor, decided not to reissue the prior year's auditors' report, but instructed Kent to include a separate paragraph in the current year's review report describing the responsibility assumed for the prior year's audited financial statements. This is an appropriate reporting procedure.

Land reviewed Kent's draft and indicated in the Supervisor's Review Notes below that there were several deficiencies in Kent's draft.

Accountant's Review Report

We have reviewed and audited the accompanying balance sheets of Tech Co. as of December 31, 20X2 and 20X1, and the related statements of income, retained earnings, and cash flows for the years then ended, in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants and generally accepted auditing standards. All information included in these financial statements is the representation of the management of Tech Co.

A review consists principally of inquiries of company personnel and analytical procedures applied to financial data. It is substantially less in scope than an audit in accordance with generally accepted auditing standards, the objective of which is the expression of an opinion regarding the financial statements taken as a whole.

Based on our review, we are not aware of any material modifications that should be made to the accompanying financial statements. Because of the inherent limitations of a review engagement, this report is intended for the information of management and should not be used for any other purpose.

The financial statements for the year ended December 31, 20X1, were audited by us and our report was dated March 2, 20X2. We have no responsibility for updating that report for events and circumstances occurring after that date.

Jordan and Stone, CPAs

March 1, 20X3

Supervisor's Review Notes

There should be no comparison of the scope of a review to an audit in the second (scope) paragraph.

Incorrect. There is and should be a comparison between a review and an audit in the scope paragraph.

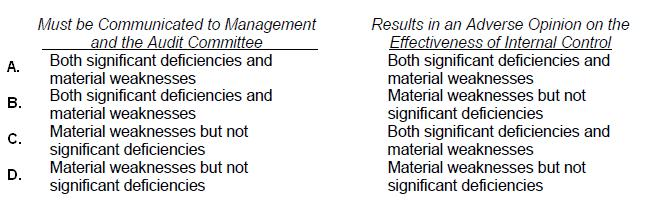

Which of the following best describes the responsibility of the auditor with respect to significant deficiencies and material weaknesses in an audit of an issuer?

Choice 'b' is correct. In an audit of an issuer, the auditor is required to communicate both significant deficiencies and material weaknesses to management and the audit committee, but only material weaknesses result in an adverse opinion on the effectiveness of internal control.

Choice 'a' is incorrect. In an audit of an issuer, significant deficiencies (that do not rise to the level of being material weaknesses) do not result in an adverse opinion on the effectiveness of internal control.

Choice 'c' is incorrect. In an audit of an issuer, both significant deficiencies and material weaknesses must be communicated, in writing, to management and the audit committee. In addition, significant deficiencies (that do not rise to the level of being material weaknesses) do not result in an adverse opinion on the effectiveness of internal control.

Choice 'd' is incorrect. In an audit of an issuer, the auditor is required to communicate both significant deficiencies and material weaknesses to management and the audit committee.

For a nonissuer, a previously communicated significant deficiency that has not been corrected, ordinarily should be communicated again:

Choice 'd' is correct. A previously communicated significant deficiency that has not been corrected ordinarily should be communicated again in writing, during the current audit.

Choices 'a' and 'c' are incorrect. The auditor is required to communicate significant deficiencies each year, regardless of whether the deficiency has a material effect on the auditor's assessment of control risk or the deficiency is considered a material weakness.

Choice 'b' is incorrect. The auditor is required to communicate significant deficiencies each year, even if the entity accepts that degree of risk because of cost-benefit considerations.